A Guide to Competitor Ad Research and Creative Analysis

Understand how to systematically analyze competitor advertising to develop stronger creative strategies and inform campaign testing.

Sections

Systematic competitor ad research is a foundational practice for building effective creative strategies. By analyzing the advertising landscape, marketers can identify trends, understand audience messaging, and formulate data-informed hypotheses for their own campaigns. This process moves creative development from guesswork to a structured workflow based on market insights.

The Role of Ad Intelligence in Modern Marketing

Ad intelligence provides a structured view of the competitive landscape, revealing the strategies other brands use to capture audience attention. It involves gathering and analyzing ad creatives to understand messaging, offers, and visual approaches across different platforms and markets. This insight is crucial for differentiating a brand and avoiding creative fatigue.

Effective research helps teams recognize what resonates with specific audience segments. It also provides a baseline for performance, allowing for more strategic goal-setting and resource allocation in paid media campaigns.

How to Structure Competitor Ad Research

A successful research process begins with clear organization. Marketers can use filters to narrow their focus by platform, such as Facebook, Instagram, or TikTok, as well as by country, media type, and date range. This ensures the collected data is relevant to specific campaign goals.

Saving notable ads into collections or folders is a critical step for deeper analysis. This allows for direct comparison of different creative approaches, messaging angles, and visual styles over time, making it easier to spot patterns and opportunities.

Creative Analysis: Key Elements to Compare

Deep analysis goes beyond simple observation. It requires breaking down ads into their core components to understand the strategic thinking behind them. The goal is to identify the tactics that drive engagement and conversions for competitors.

Brand Values vs. Direct Offers

Examine whether competitor ads focus on promoting brand values and evoking an emotional response or if they drive immediate action with a direct offer. Distinguishing between brand awareness and direct-response goals reveals insights into their overall marketing funnel and customer journey.

Platform-Specific Messaging

An ad creative that performs well on one social platform may not succeed on another. Analyze how competitors tailor their messaging, tone, and visual format for different environments. A consistent brand voice may be adapted to feel native to each platform's unique user experience and expectations.

Interactive and Rich Media Formats

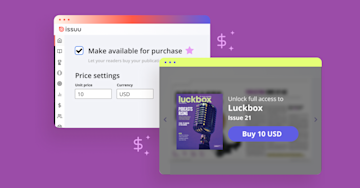

Assess the use of interactive elements in competitor ads, such as those found in digital catalogs or immersive experiences. These formats are designed to increase customer engagement and can provide a direct path to purchase. Understanding their application can inspire new approaches to creative development.

From Analysis to Actionable Hypotheses

The final output of ad research should be a set of clear, testable hypotheses. An insight, such as a competitor's successful use of user-generated content in their video ads, can be translated into a hypothesis for your own campaigns. For example: "Incorporating customer testimonials in our video ads will increase click-through rates by X%."

These hypotheses form the basis of a structured creative testing plan. By isolating variables and measuring outcomes, marketing teams can systematically improve campaign performance based on evidence rather than assumptions.

A Practical Workflow for Creative Research

Following a structured workflow ensures that research is efficient, repeatable, and directly linked to campaign objectives. This process helps teams move smoothly from discovery to testing.

- Step 1: Define Research Goals. Clearly state what you want to learn, whether it's understanding a competitor's messaging, identifying top-performing formats, or analyzing a seasonal campaign.

- Step 2: Identify Key Competitors. List the direct and indirect competitors relevant to your target market and campaign goals.

- Step 3: Collect Ad Creatives. Use an ad intelligence platform to gather a representative sample of ads, filtering by platform, date, and other relevant criteria. Save key examples for analysis.

- Step 4: Analyze Creative Elements. Systematically break down each ad, noting the hook, messaging angle, call-to-action, visuals, and format.

- Step 5: Synthesize Findings. Group your observations to identify recurring themes, patterns, and strategic trends across all analyzed competitors.

- Step 6: Formulate Hypotheses. Translate your key findings into specific, measurable, and testable hypotheses for your upcoming creative development cycle.

Common Mistakes in Competitor Ad Analysis

Avoiding common pitfalls ensures that your research efforts produce valuable and accurate insights. Awareness of these errors can help refine the analysis process.

- Mistake: Copying Instead of Learning. Directly imitating a competitor's ad ignores the unique context of your brand and audience. The corrective principle is to adapt underlying strategies, not replicate specific creatives.

- Mistake: Ignoring the Platform Context. Analyzing an ad without considering the platform where it runs leads to flawed conclusions. Always evaluate creative choices based on the norms and user behavior of that specific channel.

- Mistake: Focusing Only on Visuals. Great visuals can be misleading if the underlying message or offer is weak. A holistic analysis includes copy, headlines, calls-to-action, and landing page experience.

- Mistake: Analyzing a Small Sample Size. Drawing conclusions from just a few ads can be misleading. A larger, more diverse sample provides a more accurate picture of a competitor's strategy over time.

- Mistake: Overlooking Ad Frequency. A single ad tells only part of the story. Analyze how often different creatives are run to infer which ones are likely top performers for the competitor.